Lookup Alabama Sales Tax Rate by Address

Using an address to determine the sales tax rates in Alabama gives you greater accuracy than relying on city or zip code.

Check here for the Alabama Sales Tax Fact Sheet.

How sales tax works in Alabama

In the State of Alabama, the general sales tax rate is the sum of state tax, county tax, municipality tax and police jurisdiction (PJ) tax. The statewide sales tax is 4% as of May 14, 2023. County, municipality and police jurisdiction tax rates vary from one to the next.

To calculate Alabama sales tax by address, the challenge is to identify its county, city and police jurisdictions.

Many police jurisdictions in Alabama impose a sales tax. See this article to find out how police jurisdictions in Alabama work and to identify which police jurisdiction the address is in, if any.

Because zip codes span over multiple incorporated cities and police jurisdiction boundaries do not align with zip code boundaries, you will calculate inaccurate sales tax rates when relying on city and/or zip code locations.

For those police jurisdictions that charge a sales tax, most of their PJ tax rates are set at one-half the rate of the sales tax charged within their city limits; however, some municipalities may levy a different PJ rate. Check here for the relevant city and county tax rates as published on the Alabama Department of Revenue website.

If an address is within a municipality’s limits, the combined sales tax rate is equal to state tax + county tax rate + municipality (city) tax rate.

If an address is in an un-incorporated area and not in a police jurisdiction, the combined sales tax rate is equal to state tax + county tax.

If an address is in an un-incorporated area but within a police jurisdiction boundary, the combined sales tax rate is equal to state tax + county tax + police jurisdiction tax.

Let’s take a look at an example:

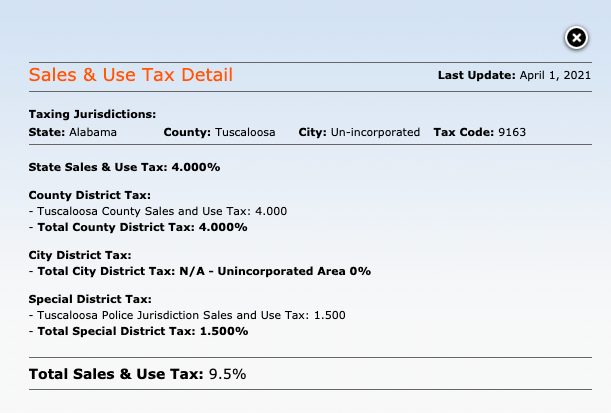

The address “7730 WUTHERING HEIGHTS LN, DUNCANVILLE, AL 35456” is in an unincorporated area within Tuscaloosa County. So, it does not have a city sales tax. However, it is in City of Tuscaloosa’s Police Jurisdiction which imposes a 1.5% sales tax. The following is a breakdown of its total sales tax:

State-wide Sales Tax: 4%

County Rate for PJ areas: 4%

Tuscaloosa Police Jurisdiction Sales Tax: 1.5%

Total Sales Tax Rate: 9.5%

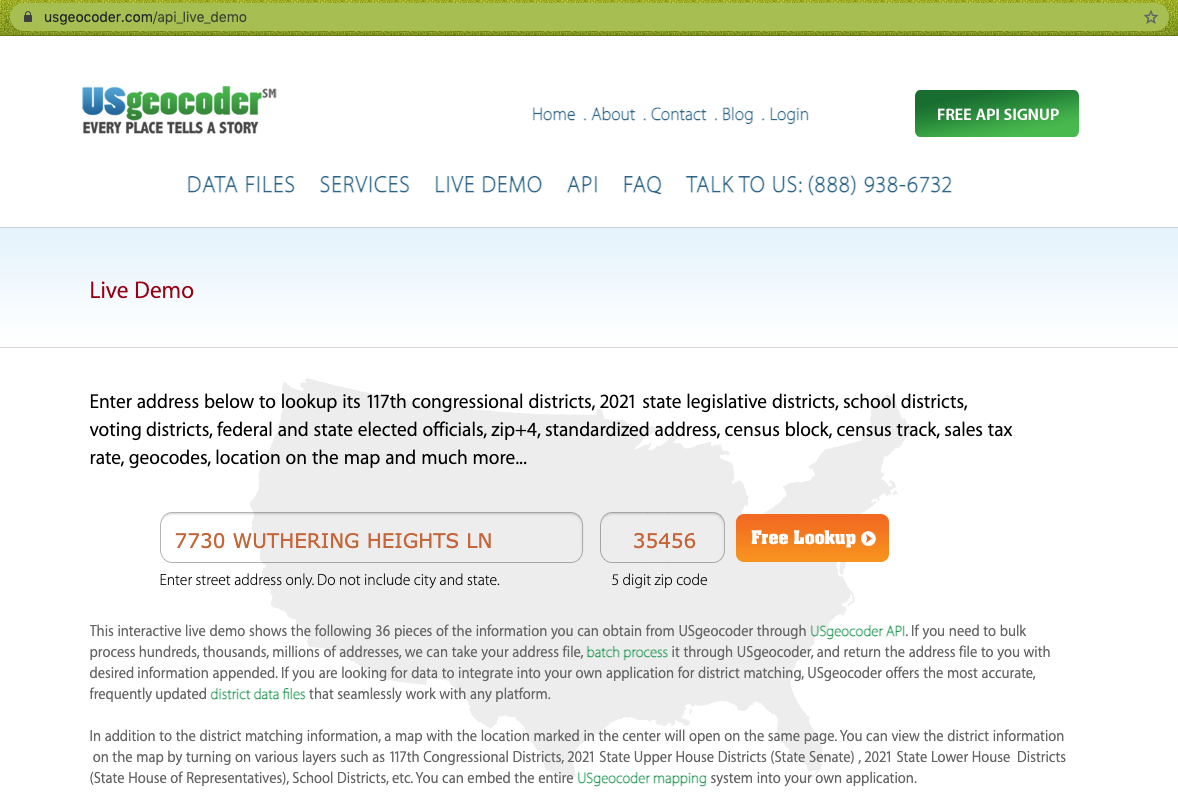

To determine the sales tax rate for any physical address or PO box in Alabama, just enter the address and the 5 digit zip code into the USgeocoder Live Demo at https://usgeocoder.com/api_live_demo (see screenshot below) and it will list the relevant tax jurisdictions and their rates.

Following is the screenshot of the sales tax information that this live demo produces for the address 7730 WUTHERING HEIGHTS LN, DUNCANVILLE, AL 35456 on May 13, 2021.

From the screenshot above, we see USgeocoder provides the tax jurisdictions and related rates that are pertinent to each address input by the user. It also provides references to the associated tax codes. Tax code is the locality code that is used on the local tax return filing.

Sales tax for remote sellers

A remote seller is an out-of-state seller that has no physical presence in Alabama. All remote sellers directly selling over the $250,000 threshold of total retail sales delivered into Alabama the previous calendar year are required to collect and remit taxes on sales into Alabama beginning on October 1, 2019.

The 8% flat tax applies to all sales regardless of the locality shipped to in Alabama. So, if you don’t have physical presence in Alabama, all you need to do is to collect an 8% flat tax rate for your sales shipped to Alabama.

Learn more about remote sellers on the Alabama Department of Revenue website at https://revenue.alabama.gov/sales-use/simplified-sellers-use-tax-ssut/simplified-sellers-use-tax-faqs/

USgeocoder provides sales tax information via API and batch services. You can connect to the USgeocoder API for realtime sales tax rates. You can also send your address file to USgeocoder in csv or Excel format and have USgeocoder append sales tax information for each record. Contact USgeocoder for your specific needs.