If you’re searching for shapefiles for sales tax jurisdiction, you already know how crucial they are for mapping tax boundaries accurately. With sales tax rates now based on exact locations rather than ZIP codes, businesses and developers need shapefiles to identify state, county, municipal, and special sales tax jurisdictions.

The problem? Obtaining reliable Shapefiles for sales tax jurisdictions is no easy task. This is where USgeocoder comes in—We provide one of the most comprehensive collections of Shapefiles for sales tax jurisdictions, sourced directly from the U.S. Census, individual states, or built from scratch when official data doesn’t exist.

Yes using Shapefiles is the only way to accurately identity Sales Tax Jurisdictions

Each state structures its sales tax differently. Here’s a breakdown of how they vary across the country:

- States with only a statewide sales tax: Connecticut, District of Columbia, Indiana, Kentucky, Maine, Maryland, Massachusetts, Michigan, New Jersey, Rhode Island.

- States with state and county sales tax: Florida, Hawaii, North Carolina, Pennsylvania, Wyoming.

- States with state and municipal sales tax: Idaho, Mississippi, South Carolina, Vermont, West Virginia.

- States with state, county, and municipal sales tax: Arkansas, Iowa, North Dakota, Oklahoma, Tennessee.

- States with state, county, municipal, and special district sales tax: Alabama, Arizona, California, Colorado, Georgia, Illinois, Kansas, Louisiana, Minnesota, Missouri, Nebraska, New Mexico, New York, Texas, Utah, Virginia, Washington.

- States with only municipal sales tax: Alaska.

- States with state, county, and special district sales tax: Nevada, Ohio, Wisconsin.

- States with state, municipal, and special district sales tax: South Dakota.

- States with no sales tax at all: Delaware, Montana, New Hampshire, Oregon.

With this many variations, the last thing you want is to charge the wrong tax rate because of incorrect jurisdiction data.

Why It’s Hard to Map Sales Tax Jurisdictions

Here’s what makes sales tax boundaries so difficult to map:

- Special district boundaries don’t always align with county or city lines.

- Sales tax jurisdictions frequently change, and outdated data leads to incorrect tax rates.

- Not all states clearly define their tax boundaries, making it hard to even start.

If you’re building tax calculation software, GIS mapping tools, or any application that relies on sales tax jurisdictions, you need Shapefiles for sales tax jurisdictions that are accurate and regularly updated. Otherwise, you risk charging incorrect tax rates, which can lead to major compliance issues.

The Problem with Using Mailing City Boundaries for Sales Tax

A major mistake businesses make when mapping sales tax jurisdictions is assuming mailing city boundaries match municipal boundaries. This is incorrect.

- Mailing cities are defined by USPS and sometimes don’t align with the actual city, town, or village limits.

- Municipal boundaries determine the official taxing jurisdictions for local sales tax rates.

In certain Northeastern and Midwestern states, townships are considered municipalities, which means their boundaries directly impact sales tax rates. If you’re using mailing city boundaries you may be applying the wrong tax rate without realizing it.

Special Tax Districts Make It Even More Complicated

Unlike counties or municipalities, special taxing districts don’t follow clear-cut boundaries. They can:

- Cover an entire county or municipality.

- Span multiple counties or municipalities.

- Overlap with other tax jurisdictions in irregular ways.

For example:

- Alabama’s Police Jurisdiction is based on city population rather than strict borders.

- Washington State has multiple transportation districts with different sales tax rates in overlapping areas.

- Texas Emergency Service Districts have irregular boundaries that span both incorporated and unincorporated areas.

Because these boundaries constantly shift, having accurate Shapefiles for sales tax jurisdictions is the only way to ensure correct tax rates.

Sales Tax Jurisdictions Change More Often Than You Think

Every state updates its sales tax jurisdictions on different schedules—monthly, quarterly, semi-annually, or even as needed. These updates may include:

- Changes to municipal boundaries.

- New special sales tax jurisdictions.

- Adjustments to existing sales tax jurisdictions.

Without up-to-date Shapefiles for sales tax jurisdictions, businesses risk applying outdated tax rates—leading to compliance headaches and possible fines.

Where to Find Reliable Shapefiles for Sales Tax Jurisdictions

Finding Shapefiles for sales tax jurisdictions is frustrating. Some states provide them, some don’t. Even when you do find them, combining everything into a usable dataset is a nightmare.

That’s why USgeocoder does the hard work for you. We specialize in providing Shapefiles for sales tax jurisdictions with:

- Comprehensive Coverage – Covering state, county, municipal, and special district tax jurisdictions across the U.S.

- Regular Updates – Keeping up with changing sales tax jurisdictions so you don’t have to.

- Multiple Data Sources – Pulling data from the US Census, state governments, and even creating our own shapefiles when official data isn’t available.

- Seamless Integration – Standardizing our Shapefiles for sales tax jurisdictions for easy integration into GIS platforms, sales tax software, and enterprise applications.

How USgeocoder Determines Sales Tax Jurisdictions

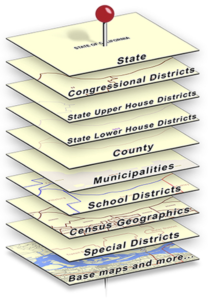

The image below illustrates how we produce sales tax jurisdictions and tax rate information. The pin is the address and each layer of maps the pin can pierce identifies classes of information available for the address. Here is how USgeocoder produces sales tax jurisdictions and tax rate information:

- Pinpoints an address location.

- Identifies its political jurisdictions such as state, county, municipality, special district, etc.

- Query our tax rate database to produce tax rate information for each sales tax jurisdiction.

All of this is built using Shapefiles for sales tax jurisdictions, sourced from the most accurate data available—or created by us when no reliable source exists.

Get Started Today:

- 💬 Live Chat: Click the Live Chat icon on the bottom right hand side of usgeocoder.com

- 📞 Call us: 1-888-938-6723

- 📩 Contact us online: Contact Us

2025 Sales Tax by State – New York

2025 Sales Tax by State – New York