New California Use Tax Collection Requirements For Out-of-state Retailers

On December 11, 2018, The California Department of Tax and Fee Administration (CDTFA) announced that beginning April 1, 2019, out-of-state retailers selling above $100,000 or 200 more separate transactions of tangible items into California during the preceding or current calendar year will be required to collect California use tax on their sales into California.

The new collection requirement is California’s interpretation of its Revenue and Taxation Code (RTC) section 6203 (section 6203) (Stats. 2011, ch. 313, § 3) and the U.S. Supreme Court’s June 21, 2018, decision in South Dakota v. Wayfair, Inc. (Wayfair) (Dock. No. 17-494).

What is the California use tax am I required to collect?

California tax rate is equal to state-wide tax plus district tax. The state-wide tax is 7.25% which consist of 6% state tax and 1.25% local tax. District taxes may be imposed by counties or municipalities (also known as incorporated cities, click here to learn more about municipalities). District tax rates are different from county to county and municipality to municipality. If you sold more than $100,000 or 200 separate transactions into a particular municipality or county in 2018 or current calendar year, you are required to collect the district tax for the respective municipality or county starting April 1, 2019. If you sell below $100,000 or fewer than 200 separate transaction, you are only required to collect the state-wide 7.25% use tax.

Here is an example given by by CDTFA:

You are located outside of California and have no physical presence in this state. You make sales through your website and prior to April 1, 2019, you were not required to be registered with the CDTFA. However, during 2018, your sales of merchandise into California exceeded $200,000. You ship all sales to your customers by common carrier. Of those sales, over $100,000 were made for delivery into the city of San Jose which imposes a district tax; the remaining sales were made for delivery throughout the state and the sales did not exceed $100,000 in any other area in California.

Under the Wayfair decision, you are considered engaged in business in California and required to register with the CDTFA and collect the use tax at the statewide rate on your retail sales to California customers on and after April 1, 2019. In addition, you are also considered engaged in business in the city of San Jose (a taxing district) because your 2018 sales exceeded $100,000 into that district. As such you are required to collect San Jose’s district use tax at the San Jose rate from your customers on your sales for delivery in the city of San Jose and pay the entire tax collected to the CDTFA. If your sales into other areas in California do not exceed $100,000 or equal 200 or more separate transactions during the preceding or current calendar year and you are not otherwise considered engaged in business in any other district, you are only required to collect the statewide rate of 7.25 percent from your customers on your sales for delivery into those areas.

Which way is easier? Keep tracking the amount of sales and number of transactions for each district or simply collect the California use tax for all districts?

There are 58 counties and 482 municipalities (incorporated cities) in California. California’s sales and use tax range from 7.25%-10.25%, depending on which districts you ship the goods to. Santa Monica and long beach in LA County are among the cities with 10.25% tax rate. Bakersfield in Kern county and Chico in Butte county do not have any district taxes. They are among the incorporated cities with no additional tax added to the state 7.25% tax rate.

To meet the new use tax collection requirements, you have two ways to collect and report California use tax.

One is to keep track of the amount of sales and number of transactions shipped to each district, if no sales exceeds $100,000 or 200 separate transactions in a given calendar year, you are only required to collect state-wide 7.25% use tax. If sales into a particular district, including county or municipality, goes over $100,000 or 200 separate transactions in a given calendar year, you will need to collect the state-wide 7.25% plus the district tax for the respective municipality or county. The pros of doing this way is that you don’t need to charge your customers the extra 0.25%-3% and leave that responsibility to your customers. In addition, you only need to report the district tax for the districts that you made over $100,000 or 200 separate transactions on your tax return. The cons is that you will need to keep an eye of the sales for each county and municipality.

The other way to do it is to simply collect the use tax for all districts. Regardless the amount of sales you make to each district, you always collect the state-wide use tax and the district use tax. The pros of this method is that you don’t need to keep track of the sales and the number of transactions of the items you sold to each district, you simply charge your customer the tax rate based on the destination like you had a retail store at that location. You collect the state-wide use tax and whatever the district use tax the designation has. The cons of this method is that if your sales is spread out all over California, you could end up reporting the individual district tax for up to 482 municipalities on your tax return.

How much is California use tax rate?

Regardless which way you will go to collect California use tax, unless you only need to collect 7.25% state and local taxes, you need to know the district tax rate of the destination to which you ship the tangible items. In addition, if an address is in an un-incorporated area, district tax does not apply. So you will need to know whether the address you ship the goods to is in an incorporated city or not.

USgeocoder provides the exact information you need. We provide the total tax rate with the break-down of the state-wide, county and city tax rates so you will have an easier time to file your sales tax returns. With GIS technology, USgeocoder is able to identity if the ship-to address is in an incorporated city or not and calculates the tax rate accordingly. USgeocoder offers 2 different ways to calculate sales tax: Mandatory Collection method and Total Collection method. With Mandatory Collection method, you get the tax rates for what you are required to collect. With Total Collection method, you get the tax rates based on the destination.

For details how these two modules work, please visit: https://usgeocoder.com/api_salestax. The information is provided in API, you can integrate the API into your online shopping cart or other online applications and get realtime California use tax rates. You can also send us an address file, we will batch process the file and append the California use tax rate information for each address.

Updates:

On April 25, 2019, California passed Assembly Bill No. (AB) 147 (Stats. 2019, ch. 5). This bill changes the threshold from $100,000 to $500,000. You can find details provided by California Department of Tax and Fee Administration on: https://www.cdtfa.ca.gov/industry/wayfair.htm.

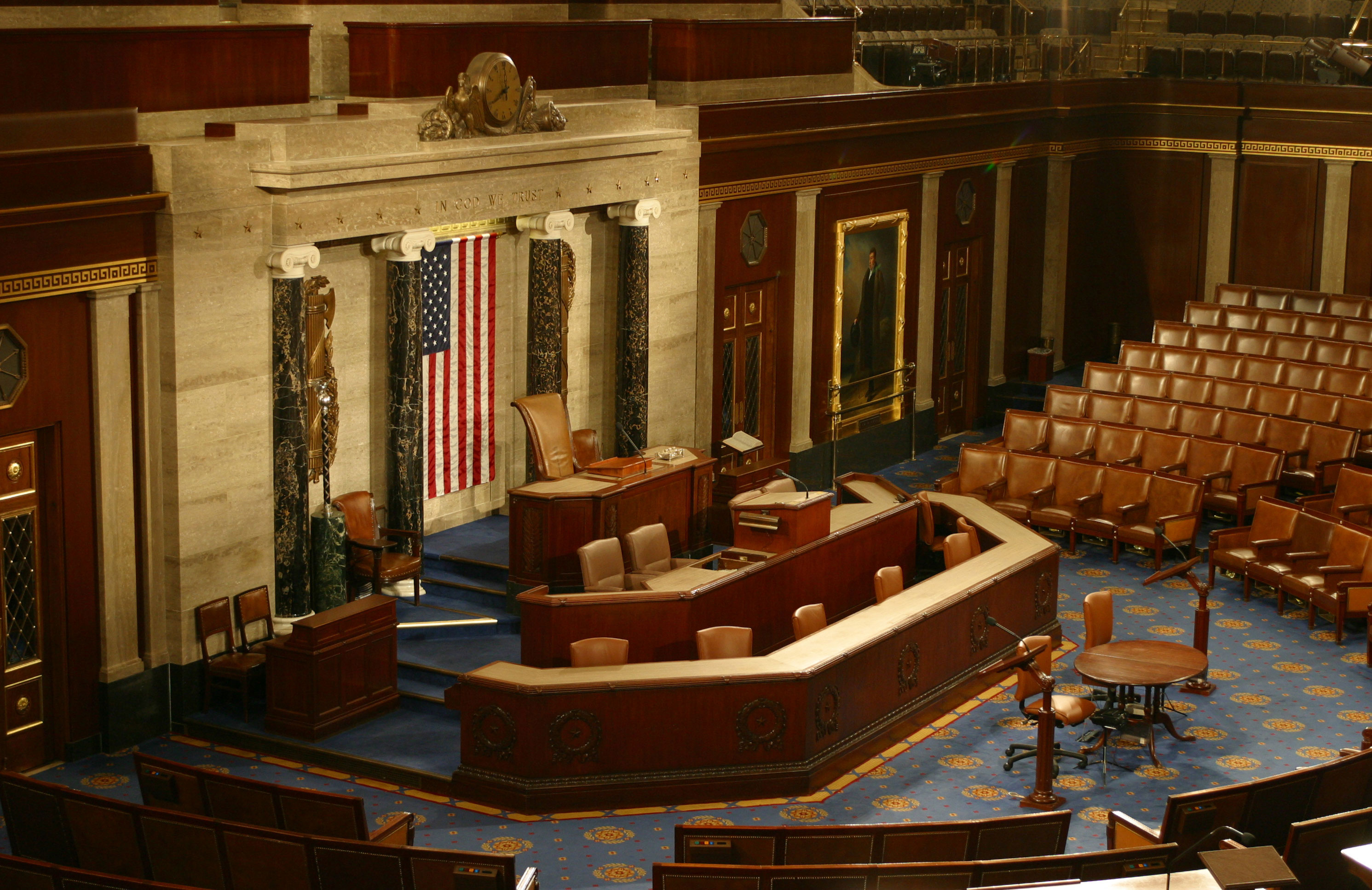

116th Congressional District Changes

116th Congressional District Changes

Leave a Reply

You must be logged in to post a comment.