How Washington State Sales Tax Rate works

Washington state sales tax rates are more complicated to calculate than most states in the United States. It consists of the state-wide sales tax, county sales tax, city (municipality) sales tax and special district taxes. For reporting purpose, some tribal lands have different reporting codes than non-tribal areas within the same city or county.

Special districts that impose sales tax in Washington State are:

- Special transit authorities:

- Transportation Washington Public Transportation Benefit Areas (PTBA)

- Regional Transit Authority (RTA)

- County transit authorities

- City transit Departments

- Gig Harbor Hospital Benefit Zone

Transportation Washington Public Transportation Benefit Areas (PTBA)

Within Washington State, there are 31 transit systems that cover all or parts of 23 counties and serve 132 cities. All collect sales tax to fund their transit operations.

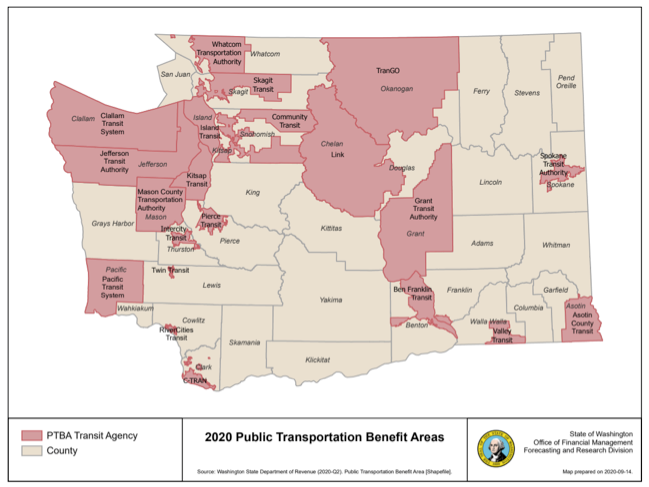

The majority of transit systems in the state are operated by public transportation benefit areas (PTBA). Below is the map for 2020 Public Transportation Benefit Areas. The areas marked in red represent the PTBA.

Source: https://www.ofm.wa.gov/sites/default/files/public/dataresearch/pop/special/ptba.pdf

Regional Transit Authority (RTA)

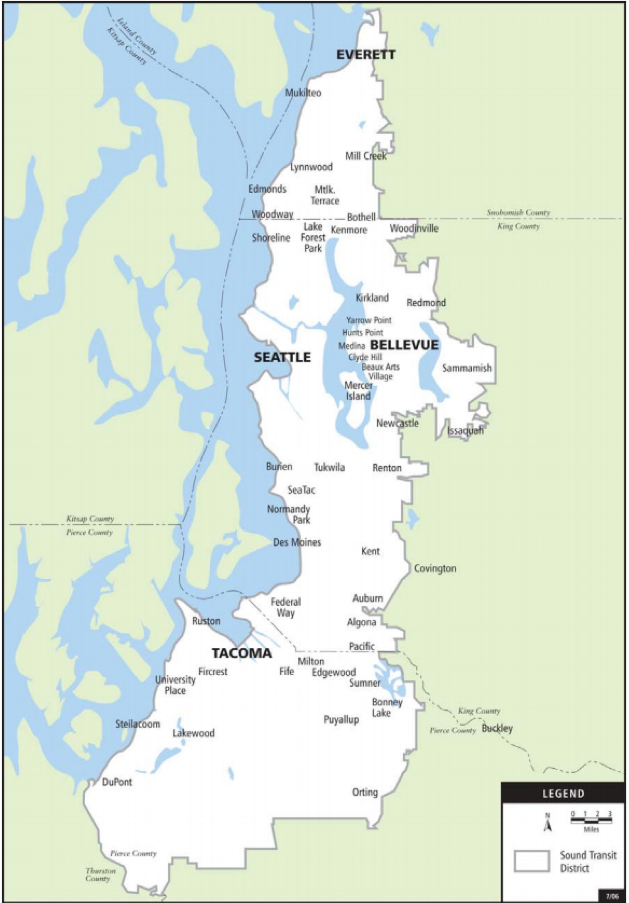

Residents of King, Pierce, and Snohomish counties who live within the Sound Transit District are required to pay the Regional Transit Authority (RTA) tax. Effective April 1, 2017, the RTA sales tax rate increased to 1.4 percent.

Below is a map that shows the Sound Transit District marked in white color.

Source: https://www.soundtransit.org/sites/default/files/documents/stdistrictmap07_10.pdf

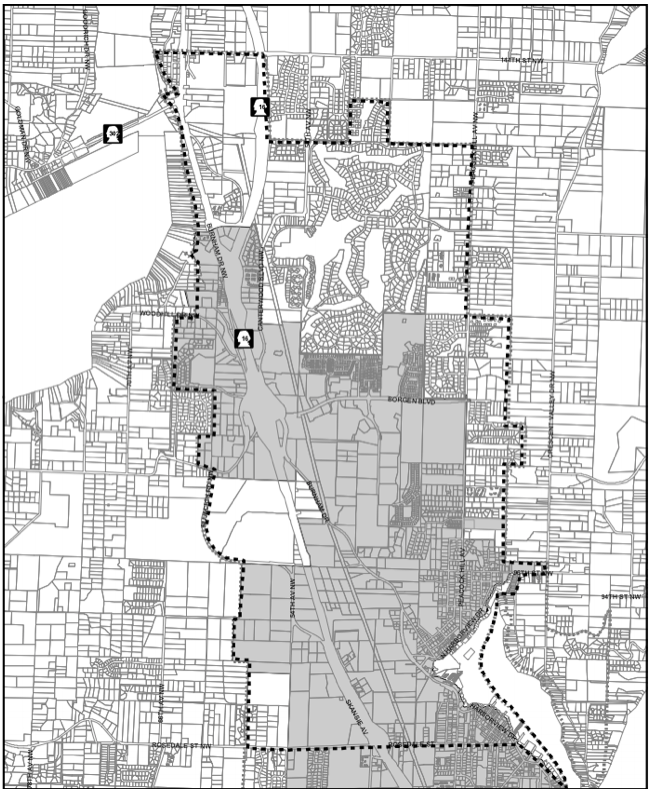

Gig Harbor Hospital Benefit Zone

This is a special zoning area that has its own sales tax reporting codes. Following is the map that shows the Gig Harbor Hospital Benefit zone:

County-wide transit includes Columbia County Public Transportation, Garfield County Transportation Authority, Grays Harbor Transit and King County Metro Transit.

City transit departments in Washington as of 2020 are Ellensburg Central Transit, Everett Transit, Pullman Transit, Selan Transit, Union Gap Transit and Yakima Transit.

How to correctly calculate Washington State Sales Tax Rates

As mentioned above, Washington sales tax includes county, city and special district taxes. The only way to be able to correctly calculate a tax rate for an address is to know the taxing jurisdictions that the address is in: county, municipality, unincorporated area, transit district, tribal reservation and Gig Harbor Hospital Benefit Zone.

The 2 common ways to calculate sales tax are by Zip Code and By Address. The main issue with using zip code is that the same zip code could spread over multiple jurisdictions and it can’t tell the difference between incorporated and unincorporated areas.

“By Address” method provides the best accuracy. However you will need a geocoder to be able to tell you the exact taxing jurisdictions the address is in. This is what USgeocoder can do for you.

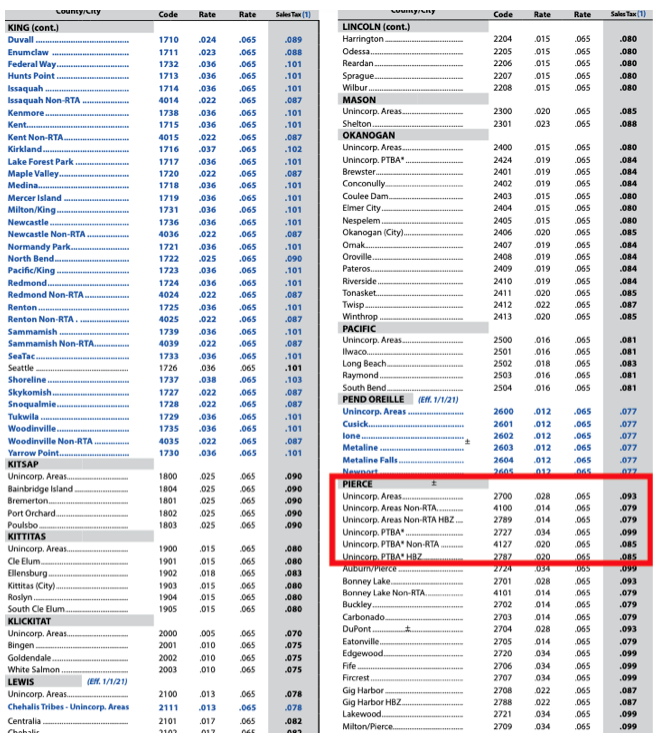

Following is a screenshot of the 2021 Q1 Local Sales and Use Tax Rates Flyer published by Washing State Department of Revenue (https://dor.wa.gov/sites/default/files/legacy/Docs/forms/ExcsTx/LocSalUseTx/LSUFlyer_21_Q1.pdf). Look at the areas in the red circle, it shows 6 different tax rates for unincorporated areas in Pierce county. To know the correct rate to use, you will need to know if the address is in an unincorporated area and if it is in a PTBA, RTA and HBZ district.

Here is an example:

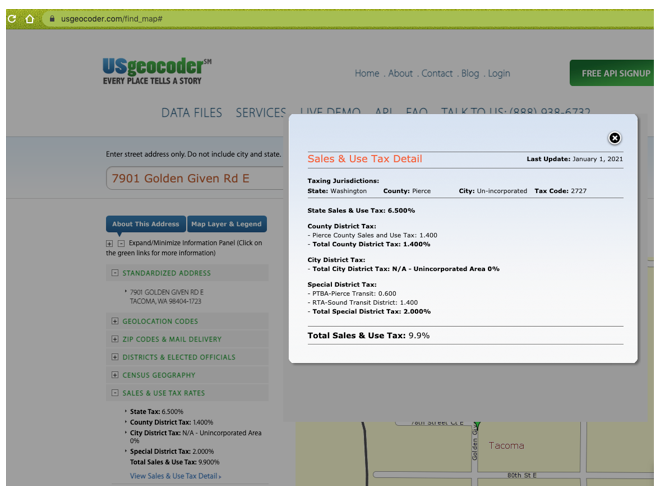

For address 7901 Golden Given Rd E, Tacoma, WA 98404, our system identifies it is in an unincorporated area, PTBA and RTA districts. Therefore, its sales tax rate is 9.9% and its tax reporting code is 2727.

Here is the screenshot of the live demo (https://usgeocoder.com/api_live_demo) that shows the above results, You can see its tax rates at the county, municipality and special district levels.

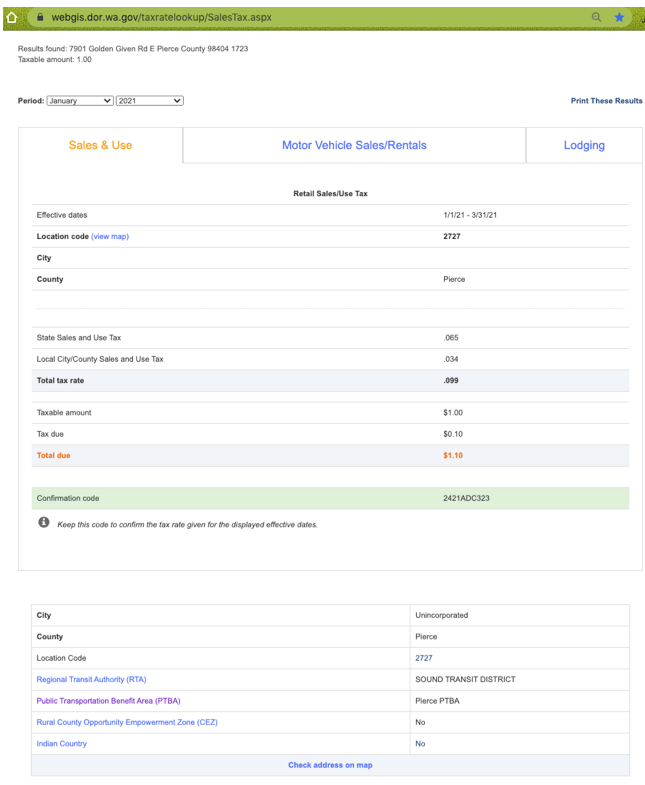

Here are the results from the lookup page from the Washington State Department of Revenue for the same address. It confirms the rate information produced by our system.

Reference link: https://webgis.dor.wa.gov/taxratelookup/SalesTax.aspx

To test out other addresses, just enter the address and its 5 digit zip code on our live demo: https://usgeocoder.com/api_live_demo, press “Free Lookup” button and you will see the sales tax information on the last tab on the result page.

Are you looking for statistic and more information about Washing State Sales Tax? You might find this blog article helpful.

If you are looking for a service to batch process your address file or provide real time sales tax information for your online application, please contact us by phone at (888) 938-6732, by chat at USgeocoder.com or fill out the online inquiry form on: https://usgeocoder.com/contact_us.

Is a township in Northeastern and Midwestern states considered municipality?

Is a township in Northeastern and Midwestern states considered municipality?