Introduction to Louisiana Sales Tax Domicile Codes

Most State and local governments in the United States levy sales and use taxes based on where a transaction occurs. In destination‑based states, sellers are required to calculate and collect not only the state rate but also local taxes imposed by counties (parishes in Louisiana), municipalities and special districts. To simplify reporting and ensure that tax revenues flow to the correct jurisdictions, some states issue jurisdiction codes that identify each unique combination of local taxing authorities.

Louisiana calls these codes “domicile codes.” Each domicile code is a four‑digit number that combines a two‑digit parish code and a two‑digit code for a municipality or special district within the parish. This article—part of a series exploring state‑by‑state tax‑code systems—explains what domicile codes are, how they are constructed, how they appear on tax forms and official documents, and how businesses can look them up and use them for compliance.

What Are Sales‑Tax Jurisdiction Codes?

In many states, businesses must report local sales and use taxes by jurisdiction. Jurisdiction codes (sometimes called location codes, tax area codes or domicile codes) provide a shorthand way to reference a particular combination of state, county/parish, municipal and special‑district taxes. When filing returns, sellers enter the jurisdiction code and the tax due for each code so that the revenue is allocated correctly. Without such codes, taxpayers would have to describe each locality in plain text, increasing the risk of misallocation.

Why Louisiana uses “domicile”?

Louisiana’s Civil Code defines a person’s domicile as the place of habitual residence; for a company, domicile can be the state of formation or principal place of business . Borrowing this legal term, Louisiana issues domicile codes to identify where sales occur. On state documents, the domicile code acts as a proxy for the address’s taxing jurisdictions.

What Is a Domicile Code in Louisiana?

A Louisiana domicile code is a four‑digit number with the following structure:

- Parish code (2 digits) – identifies the parish (county) where the address is located.

- Domicile code (2 digits) – identifies the municipality or special district within the parish.

The final four‑digit code is created by concatenating the parish code and the two‑digit domicile code. For example, the Louisiana tax‑rate data set lists Acadia Parish (parish code 01) with several domiciles. When the parish code and domicile code are combined, they yield:

| Four‑digit code | Parish | Municipality/Special district |

| 0100 | Acadia | Acadia Parish (unincorporated) |

| 0101 | Acadia | Crowley |

| 0102 | Acadia | Church Point |

The same pattern applies across all parishes.

How Louisiana Domicile Codes Work

Domicile codes are more than identifiers—each code corresponds to a specific combination of tax rates and is tied to a column letter on parish‑level tax forms. A few examples illustrate how the system works:

- Rapides Parish – The parish’s sales‑tax return lists codes 4001 through 4007 (Alexandria, Pineville, Boyce, Ball, Woodworth, Le Compte and Forest Hill). Each code is assigned a column letter and a local rate (e.g., 5.5 % for Alexandria and Pineville) . Additional codes such as 4010 and 4009 cover special districts with different rates .

- Washington Parish – Codes 5903 (Angie), 5902 (Bogalusa), 5901 (Franklinton), 5905 (Varnado), 5904 (Enon) and 5906 (Thomas) appear on the parish return. Each code links to a column letter (A, B, C, etc.) and a specific local rate .

- New sub‑jurisdictions – In 2025 Baton Rouge added special districts such as St. George and Americana Economic Development District, each with its own domicile code. Local tax authorities emphasized that using the wrong code can misdirect tax revenue .

The state rate also forms part of the total. Following a 2024 special session, Louisiana increased the state sales‑tax rate to 5 % effective January 1 2025 . The local rates listed above are added to this state rate to calculate the total sales tax.

How Domicile Codes Are Used for Sales‑Tax Reporting

Because Louisiana taxes are destination based, the tax rate depends on where goods are delivered. Domicile codes are used in several ways:

- Tax calculation and reporting – Businesses look up the domicile code for each transaction to find the applicable rates and columns on the parish return. For example, the Rapides Parish form divides local rates into columns A, B, C, F and G; the Washington Parish form uses columns A through F . Correctly reporting the code ensures that the tax is allocated to the proper jurisdictions.

- Remote seller registration – The Louisiana Sales and Use Tax Commission for Remote Sellers requires remote sellers to file returns using domicile codes. Vendors must register and select the appropriate code when importing transaction data. Act 11 of the 2024 Third Extraordinary Session also repealed vendor’s compensation for remote sellers .

- Destination‑based application – Louisiana is a destination‑based state, so the rate is determined by the delivery address. Sellers must use the domicile code of the customer’s address rather than the seller’s location.

- New combined return (2026) – Beginning with December 2025 sales (filed in January 2026), Louisiana will implement a combined state and parish sales and use tax return. Taxpayers must register with the Parish E‑File (PEF) system to obtain a unique identification number and must report tax for each parish where a transaction occurs; otherwise the return may be rejected . Accurate domicile codes remain essential to ensure that the combined return allocates taxes correctly.

How to Find a Louisiana Domicile Code and Sales‑Tax Rate

State Lookup Tools

Louisiana’s Local Sales Tax Board provides an online lookup tool (accessible via the Remote Sellers Commission or Parish E‑File websites) at https://taxes.mfn.dps.la.gov/ where businesses can enter a parish, municipality and whether they are inside city limits to retrieve the domicile code and the applicable rates. Users must create an account to access the tool .

Manual lookup using the tax‑rate dataset

The Parish & Municipality Tax Table published at https://taxes.mfn.dps.la.gov/ lists every parish with its two‑digit code, the domiciles within that parish and their two‑digit codes . By combining the parish code and domicile code, users can reconstruct the four‑digit domicile code. For example, Acadia Parish (01) has domicile codes 00 (unincorporated), 01 (Crowley) and 02 (Church Point), producing codes 0100, 0101 and 0102 .

Address‑based lookups

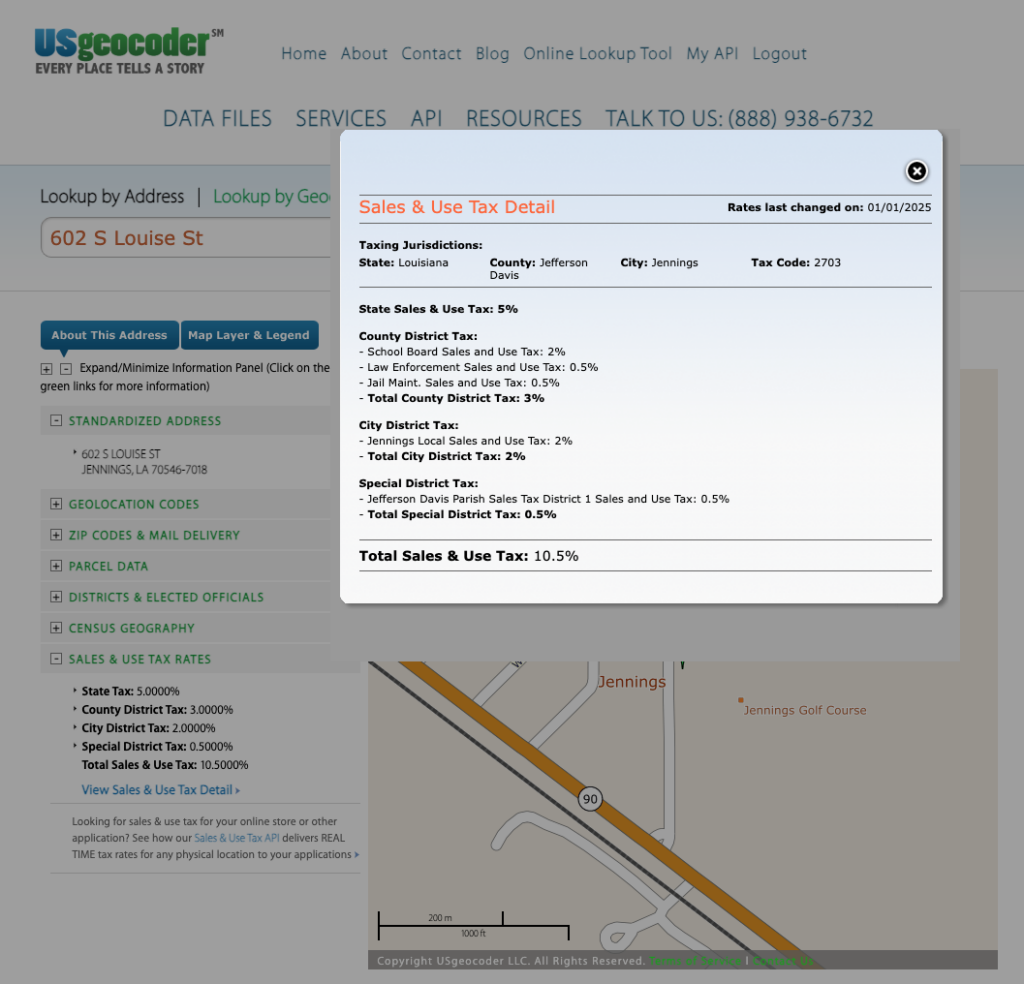

Businesses that need to compute tax rates for specific addresses can use USgeocoder’s service. For instance, an address‑level lookup for 602 S Louise St, Jennings, LA 70546 returns domicile code 2703 (Jefferson Davis Parish, City of Jennings) and the following rates:

- State: 5 %

- Parish (Jefferson Davis): 3 %

- City (Jennings): 2 %

- Special district (Jefferson Davis Parish Sales Tax District 1): 0.5 %

- Total combined rate: 10.5 %

Following is the screenshot of the sales tax information provided by USgeocoder’s Online lookup tool:

Why Domicile Codes Matter for Businesses and SaaS Platforms

Accurate domicile codes are critical because they:

- Ensure correct tax calculation – Mis‑coding can result in under‑collecting or over‑collecting local taxes. Tax authorities stress that incorrect domicile codes may misallocate revenue and could lead to penalties .

- Streamline reporting – With thousands of potential combinations of parishes, municipalities and special districts, a four‑digit code simplifies data entry and aligns with return columns.

- Facilitate compliance for remote sellers – Interstate sellers must collect local taxes based on the customer’s destination. Domicile codes allow remote sellers to comply with Louisiana’s economic nexus laws and avoid rejected returns.

- Support automation – SaaS platforms and tax‑technology providers can integrate domicile codes into checkout and invoicing systems to automatically compute the correct rates. This reduces manual errors and improves customer experience.

How to Automate Domicile‑Code Lookup

Manual lookup can be time‑consuming, especially when processing thousands of transactions. Address‑validation services and APIs can automate the process:

- USgeocoder API – Developers can send addresses to the USgeocoder API and receive the domicile code, taxing jurisdictions and applicable rates. For example, sending an address like 602 S Louise St, Jennings, LA 70546 returns code 2793 and the rate breakdown shown above. USgeocoder offers a free trial (two weeks or 1,000 lookups) for API service and an online lookup tool to lookup domicile code and sales tax information one address at a time.

- Parish E‑File tools – Once registered, businesses can use the PEF system to import returns with domicile codes and rates.

These services reduce the risk of errors and help remote sellers maintain compliance.

Conclusion

Louisiana’s domicile‑code system is central to accurately collecting and reporting state and local sales taxes. Each four‑digit code encapsulates the complex combination of state, parish, municipal and special‑district rates that apply to a given address. With the state rate at 5 % and numerous local jurisdictions imposing their own taxes, using the correct domicile code ensures that tax revenues flow to the proper governments.

Businesses, developers and tax professionals should familiarize themselves with Louisiana’s domicile codes, use the state’s lookup tools or geocoding services to identify the right codes, and integrate this data into their invoicing and reporting systems. Doing so will minimize compliance risk and lay the groundwork for successful operations in a destination‑based sales‑tax environment.

2026 Sales Tax by State

2026 Sales Tax by State